A Biased View of Financial Advisor Definition

Wiki Article

About Financial Advisor Meaning

Table of ContentsSome Known Incorrect Statements About Financial Advisor Fees The Single Strategy To Use For Financial Advisor MagazineThe Ultimate Guide To Financial AdvisorThe Ultimate Guide To Financial AdvisorThings about Financial Advisor JobsThe Facts About Financial Advisor Meaning UncoveredUnknown Facts About Financial Advisor Near MeThe Greatest Guide To Financial Advisor CertificationsGetting The Financial Advisor Job Description To Work

Besides saving you the hours of job required to load out such a lengthy income tax return, an excellent accounting professional can assist you save money on taxes by making smart choices throughout the year. As well as for small company owners, an accounting professional is essential to aid you remain on top of such issues as worker pay-roll, company reductions, and quarterly tax filings.

Insurance agents make their money marketing insurance policy policies, however that's not all they do. Since they understand all the ins and also outs of the insurance company, they can educate you regarding the different types of insurance and what you require based on your scenario. Some insurance representatives can also aid you contrast plans from different firms to locate the very best bargain.

How Financial Advisor can Save You Time, Stress, and Money.

These economic pros make their money from the insurance companies. Some job for just one firm and gain an income; others work separately and gain their money from payments on the sales they make.How to Choose if You Need One In the past, if you needed insurance, mosting likely to an agent was the only means to obtain it. Nowadays, nonetheless, it's possible to look for insurance straight online. You can quickly see the sites of various companies to get quotes and also contrast them to see which provides the best rate.

Buying straight is convenient, and it's in some cases feasible to find a lower price by doing this. When insurance companies sell their policies through a representative, they need to pay that person a payment, and that extra expense gets factored into the cost. When you shop straight, there's no compensation, as well as sometimes those financial savings are passed on to you.

Things about Financial Advisor License

For one, a regional insurance coverage representative will certainly know your location, so if you have a case, the agent may be able to advise a regional car body store for any solutions you could require. Representatives can likewise approve cash money repayments something a website can not do. And also lots of people simply value the personal touch of being able to talk with a representative in person and have their concerns addressed.These agents market plans from a variety of providers, so they can aid you compare prices and also pick the plan that's the most effective suitable for you. Restricted agents, by comparison, offer plans from just one firm. The very best way to discover a great insurance policy representative is to request references.

If they have actually been mosting likely to the exact same representative for years and have actually always been pleased with the service, that's a great indicator. 3. Lawyer You may not assume of an attorney as a monetary expert. The majority of people's photos of lawyers are probably restricted to the ones they see on television: primarily court room legal representatives defending offenders.

Fascination About Financial Advisor Ratings

Legal, Zoom states that if you desire added estate preparation solutions along with your will, such as a power of attorney, you can expect to pay around $1,000 if you're single. For couples that require joint papers, the price is regarding $1,500. A living count on is a fund that holds possessions and also passes them on your heirs after your death.Nolo says establishing one up costs a minimum of $1,200 to $1,500, while Legal, Zoom puts the rate in between $1,000 as well as $2,500. You can also complete this through for simply $399. In some states, you're required by regulation to have an attorney supervise the closing on a residence acquisition. In others, it's up to you whether to hire a legal representative.

Financial Advisor Definition for Beginners

As an example, if you need assistance with estate preparation, discover a legal representative that's a professional in estate legislation. Working with a divorce legal representative to compose your will is like hiring a plumbing professional to re-shape your residence it's simply not the same skill collection. To locate the sort of lawyer you require, start by requesting references from friends and family.Make sure the attorney is licensed to practice in your state Continue as well as is trained in the area you require aid with.

As well as if you have a certain financial need that requires a professional, such as an attorney, your monetary planner can aid you find one. Just How Much They Cost Financial planners are typically paid by the hr. Per hour prices typically vary from $150 to $300, according to Stone Tips Financial.

How Financial Advisor License can Save You Time, Stress, and Money.

Getting wedded as well as having youngsters are momentous events in your life that have a large effect on your funds. When you obtain married, you need to determine such issues as how to incorporate your funds and whether to submit your taxes collectively or individually. Having kids needs you to make modifications to your budget and think of saving for college. People with this title have actually completed a strenuous program in financing and also passed a collection of tests dealing with subjects like insurance policy and also estate planning. CFPs are also read the article fiduciaries, which means they're legitimately bound to act in your best financial interests, also if they make much less cash this method. Nevertheless, there are also knowledgeable economic organizers with different titles.Hiring a PFS can make good sense if you need aid with tax obligations or various other audit requirements particularly. The best financial planner for you is one who deals with customers whose needs resemble your very own. Ask around for referrals from other individuals who are in the very same monetary circumstance as you, such as little company proprietors or brand-new moms and dads.

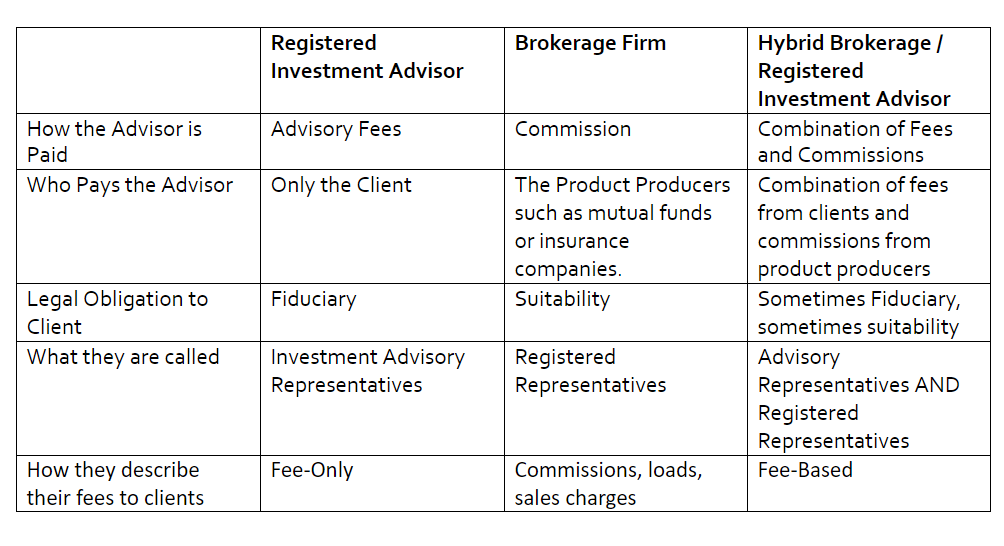

Just How Much They Expense Some investment consultants are "fee-only," which suggests they make all their cash directly from you. They can charge a hourly price, yet more frequently, their charge is based on the quantity of the possessions they're handling for you. financial advisor certifications. For example, if you have a portfolio worth $250,000, you could pay a consultant 1% of that, or $2,500 each year, to manage it for you.

Some Known Questions About Financial Advisor Ratings.

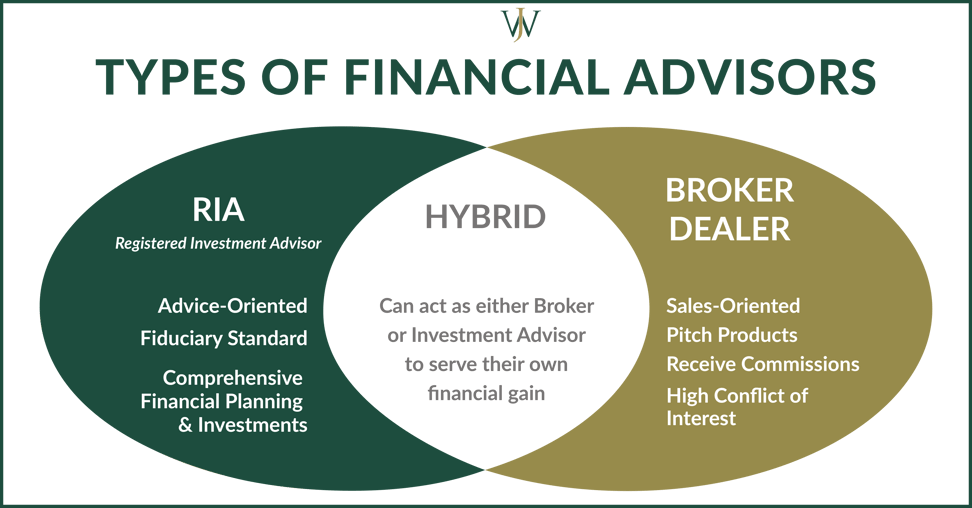

You might pay reduced fees with this type these details of advisor, yet there's a downside: They have a reward to offer you items you do not need just to gain the payment. Exactly how to Choose if You Required One The more cash you have to handle, the much more you need to obtain by ensuring it's managed well.People and also companies birthing this title are registered with the Securities Exchange Compensation (SEC) and are legally bound to serve as fiduciaries. You can find one by looking the SEC site. has a valuable tool where you can address a few inquiries and they will match you with three potential economic advisors so you can determine that would be the most effective fit (financial advisor license).

You pay a specific quantity each month to the counselor, as well as they disperse the money to your lenders. Sometimes, when the counselor sets up the DMP, they can negotiate with your creditors to obtain you a lower rate of interest or forgo fines for previous late payments. Just How Much They Expense The price of debt counseling depends on what type of solution you make use of.

The Main Principles Of Financial Advisor Ratings

If you sign up for a DMP, you will always need to pay a fee despite having a not-for-profit firm. Usually, there is a single charge for establishing up the DMP, which is generally in between $25 and $75. In addition to that, you have to pay a month-to-month charge for the service, which relies on the quantity of your debt and also the variety of financial institutions you have.Just how to Decide If You Required One Clearly, you just need debt therapy if you have financial debt. It additionally needs to be an amount of financial obligation that you can not conveniently handle on your very own, as well as a sort of financial obligation that a debt therapist can aid with. Right here are a couple of methods to inform if debt therapy is a good suggestion for you:.

According to specialists, if your DTI is below 15%, your financial obligation goes to a convenient level. If it's any higher than that, that's an indicator that you're an excellent prospect for credit counseling. Having a excellent credit rating score at the very least 700 means you have a lot more choices for taking care of debt.

6 Simple Techniques For Financial Advisor

As soon as you find a firm that looks reasonable, start asking concerns - financial advisor job description. Figure out what services it supplies, whether it's certified to practice in your state, and also what credentials their participants have. If you require to handle a specific sort of financial debt, such as home loans, trainee lendings, or medical bills, you can seek an agency that concentrates on this location.Report this wiki page